Getting the Help You Need After a Storm

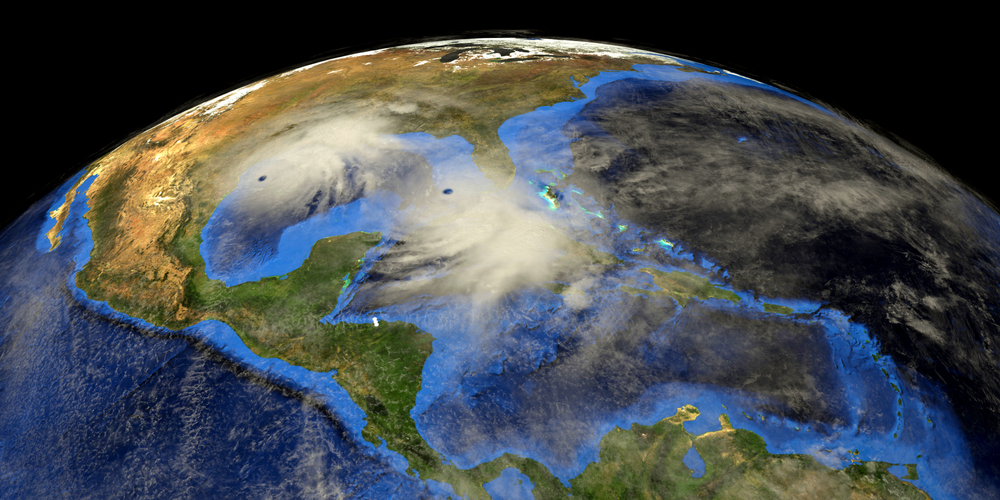

As of Wednesday, August 26, Hurricane Laura is headed straight for the Texas and Louisiana coasts. The National Hurricane Center is now projecting that the storm will strengthen to a Category 4 before making landfall with “catastrophic storm surge, extreme winds, and flash flooding.” For many Gulf Coast natives, hurricanes are a devastating reality each year.

Hurricanes are the costliest natural disasters in the United States, according to the Insurance Information Institute (III). Despite knowing that some families lose everything in these events, many disaster-related insurance claims are denied, and many Americans are left with nothing to rebuild.

If you are facing loss after Hurricane Laura, contact The Karam Law Office. Our knowledgeable attorneys can help you get compensation for your property loss related to the storm. We know the tactics that insurance companies use to deny claims and will fight to get you the money you deserve. Call (832) 376-6543 to speak with an experienced lawyer regarding your claim.

Why Storm-Related Insurance Claims Get Denied

Many people believe that their insurance company has their best interest at heart. Unfortunately, insurance companies routinely use unscrupulous tactics to deny a claim or pressure a person into a reduced settlement. An insurance representative may tell you that you don’t have sufficient coverage, that your policy only covered wind damage and not flooding, or that you reached your coverage limit. In some cases, an agent may deny your claim arguing that you failed to provide sufficient documentation regarding your damages or that the damages were pre-existing.

According to the Naples News, after Hurricane Irma, it is estimated that insurance companies denied up to 75 percent of initial roofing claims. Representatives for the insurance companies would routinely claim that the roof damage was pre-existing and not related to the hurricane.

As noted by the Americans for Insurance Reform, insurance agents denied coverage to vast numbers of homeowners after Hurricane Katrina, claiming that damage was primarily done by flooding, which was not covered by their policies.

The stories are the same for nearly every hurricane to hit the United States. Fighting to recover your losses can become a frustrating and overwhelming experience that leaves you without funds when you need them most. Our attorneys will stand up to the insurance company, being your advocate and your champion to get you the compensation you need to rebuild after a tragedy.

Understanding Your Rights and Filing a Claim After a Storm

If you experience property damage or other losses related to Hurricane Laura, it is essential to know that you have rights and that you are protected from insurance agents that act in bad faith to deny claims.

First and foremost, thoroughly read through your insurance policy or schedule an appointment to review your coverage. The more you know prior to needing to file a claim, the better prepared you will be in the long-term.

If your home is damaged by a storm, you have the right to file a claim for damages. Make sure to contact your insurance company as soon as possible after the storm to report damages. Keep a record of everyone you speak to and document what is promised. Be prepared to discuss the damages and set up an appointment to have your property appraised. You may be entitled to an advance payment depending on your policy. Ask about their process and what is covered.

The insurance company will send an adjuster to review your claim. It is in your best interest to be present during the adjuster's inspection and point out all damage caused by the storm. Do not make any permanent repairs to your property before the adjuster arrives. If you need to make temporary repairs, carefully document them by saving your receipts and taking pictures. You have the right to get bids from contractors to compare with the recommendations of the adjuster. Generally, you will not want to settle a claim before having the damages inspected by an independent party.

Insurers must acknowledge receipt of the claim and commence an investigation within 15 days of receiving notice. If your insurance company is not getting back to you regarding your claim, you need to act fast to protect your rights.

What to Do When Making a Hurricane Damage Claim

One of the most important things you can do to protect your interests is to know your policy and what is covered in the event of a catastrophic event. Too often, homeowners are left empty-handed by an insurance company that is unwilling to pay for damages because of a loophole in the policy.

Other ways to ensure that you get full compensation for your losses include:

- Contacting your insurance company promptly – do not wait until it is too late.

- Taking pictures of your damages – document everything.

- Save receipts for anything related to the storm, including temporary repairs and living expenses if you were displaced.

- Having your case reviewed by an experienced attorney if your claim is denied.

Turn to a First-Party Insurance Lawyer from The Karam Law Office

After a storm, you expect that the insurance company will be the first one to help you recover. Unfortunately, for thousands of people, the exact opposite is true. Insurance companies deny claims even when people are completely displaced from their homes. Our knowledgeable attorneys can help you with your first-party insurance claim. As skilled litigators, we know how to hold insurance companies accountable and get you the money you deserve for your losses. Contact The Karam Law Office today at (832) 376-6543 if you get denied by your insurance company.